Colder than average air is expected to remain place across the northern tier of the U.S. through the end of meteorological winter, while the South and Southwest are likely to see a mild winter, according to the latest outlook from The Weather Company, an IBM Business.

Throughout the first three months of the year, temperatures are more likely to be above than below average across the Southwest into Texas. The Upper Midwest will likely see below average temperatures.

Here's the outlook month-by-month:

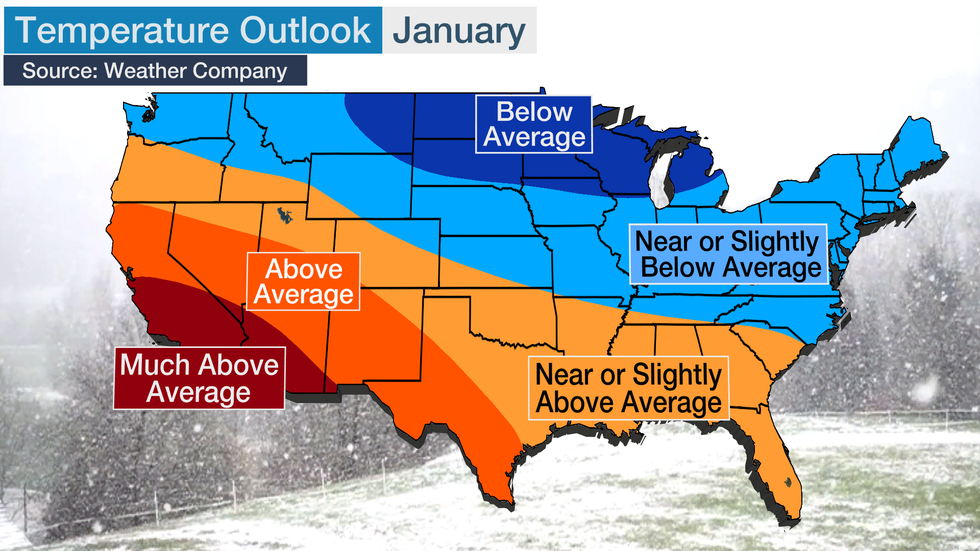

January

If you're looking for a winter getaway, head down to California and Arizona for much above average warmth, by winter standards. Typical winter highs are already in the 50s and 60s in those states.

Near average temperatures are expected from the Pacific Northwest through the Central Plains and into Southeast.

The most likely spot for cooler temperatures compared to average will be from the northern Plains into the Upper Midwest. Highs there are usually in the teens and 20s to start the year.

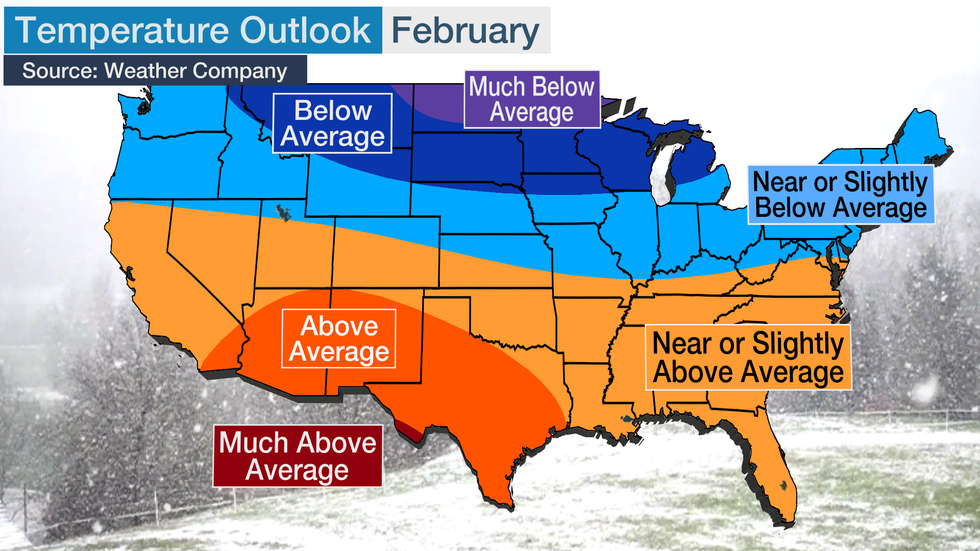

February

Temperatures going into February are expected to be well below average for a large swath of the Midwest and Plains.

Far-below-average temperatures are likely in those regions, with below-average temperatures also reaching into the northern Rockies. February is normally the coldest month of the year in many of these areas, but the outlook calls for even colder weather than usual.

Milder than average conditions are likely from southern California to much of Texas.

Much of the country should be near average, meaning highs in the 40s and 50s for the mid-Atlantic, mid-South, central Plains and the Great Basin and highs in the 20s and 30s in the Northeast. Much of the South will see highs in the 60s and 70s.

Occasional bursts of cold or warm air could bring significantly higher or lower temperatures, but this should be a good idea of how February will go as a whole.

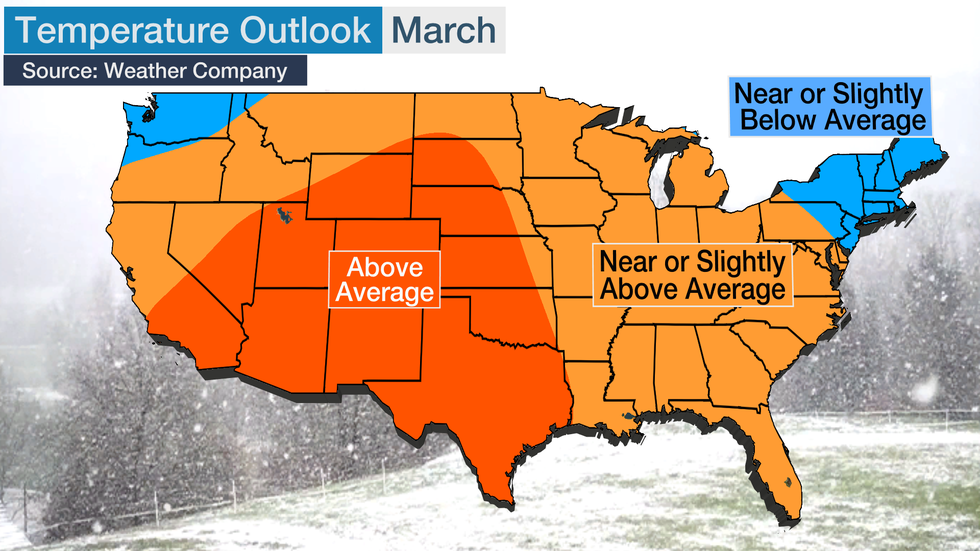

March

The outlook from the Weather Company suggests that some significant changes are possible as winter ends and spring begins.

Milder air will likely expand to much of the western half of the country, and average or slightly above average temperatures are possible over an even broader area. Together, these regions include most of the Lower 48 states.

This could bring highs in the 60s into the central Rockies and 70s in the the Southwest.

Slightly below average temperatures are possible across Washington state, as well as New England and parts of the adjacent Northeast.

The Science Behind the Outlook

Dr. Todd Crawford, chief meteorologist with The Weather Company, notes a few factors that led to his above outlook.

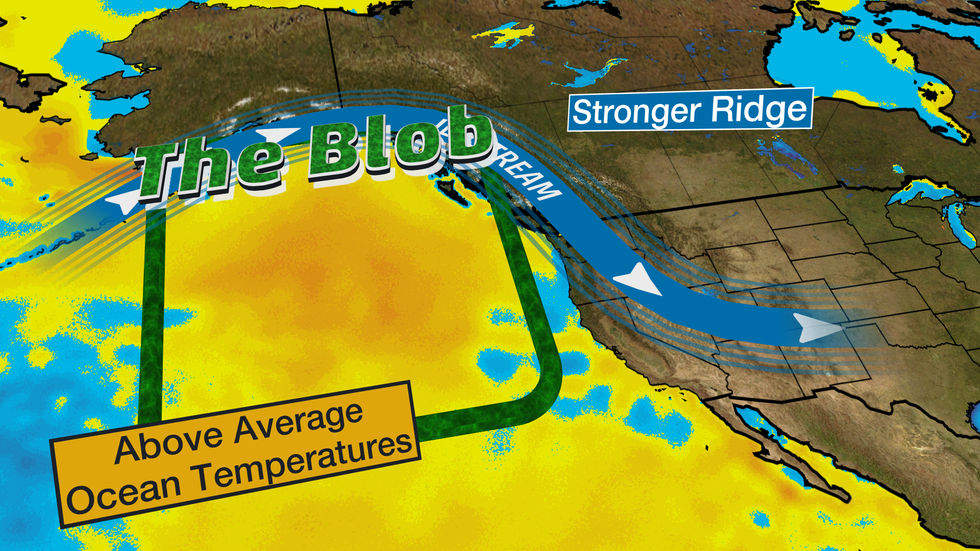

Two of the most important are a westward shift in warm tropical Pacific waters and the return of "the blob" (unusually warm waters in the North Pacific).

Together, he said, these favor "a steady stream of cold air into Canada and parts of the northern US."

The blob, a recurrent pool of warmer than average water off the western coast of North America, changed the course of the winters of 2013-14 and 2014-15. In each of those winters, warmer conditions developed in the West or Southwest, while cooler than average conditions developed in the Midwest and mid-South.

The warmer ocean temperatures were linked to higher pressures developing aloft, which forced the jet stream northward over Alaska and the western U.S.

The blob has developed once again, and Crawford thinks it may once again have impacts for the winter ahead. This means that January and February could see mild temperatures in the West or Southwest and cooler temperatures around the northern Plains and Great Lakes.

.

El Niño Possible in Early 2020

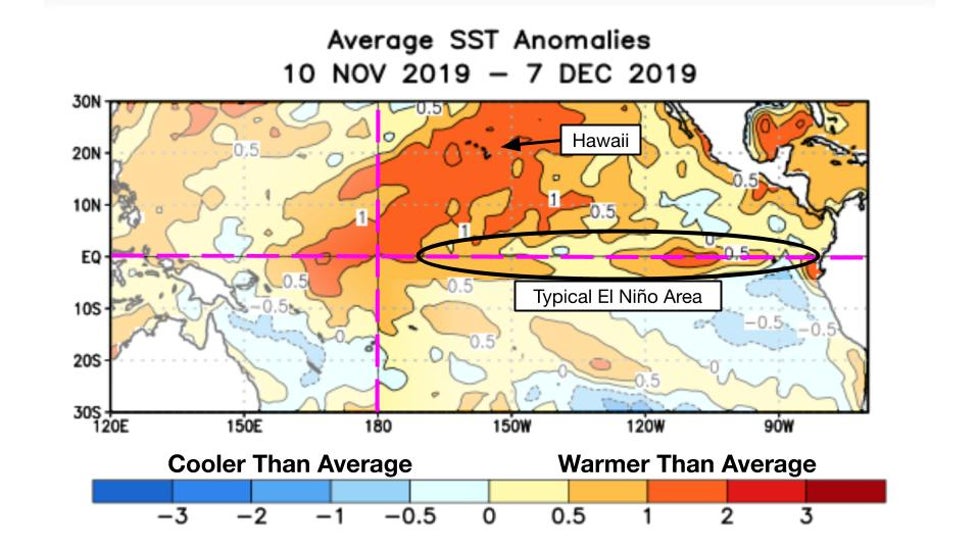

A second factor is a west-shifted El Niño, which is typically referred to as modoki El Niño. This pattern includes warmer than average ocean temperatures in the central Pacific closer to Hawaii and the International Date Line (the vertical pink line below).

Ocean temperatures in the last few weeks have been considerably warmer in the central Pacific (compared to average) versus the eastern Pacific.

The effects of a modoki El Niño, which has a different set of impacts than a classic El Niño, are expected to factor into North American weather this winter.

Modoki "would favor ridging in the NE Pacific and the coldest temperatures across the north-central US and our winter forecast continues to reflect this idea," according to Crawford.

This type and intensity of El Niño is about what we saw in the winter of 2018-19 as well.

Through early December, sea surface temperatures have not been warm enough in the eastern tropical Pacific where we typically watch for classic El Niño development. According to the Climate Prediction Center, we're currently in neutral El Niño/Southern Oscillation conditions, when we look at ocean temperatures in the eastern Pacific and winds in the same region.

This isn't to say that a classic El Niño couldn't develop.

Forecasters at NOAA and the International Research Institute are calling for a 25% chance of more classic El Niño conditions for January - March 2020.

Also, if this outlook sounds somewhat familiar to last year, it's because conditions may be very similar.

In fact, through the end of autumn, temperature patterns – the locations of warmer- and colder-than-average conditions – have been almost exactly the same as last year, according to Crawford.

There are some indications that these similarities will continue in 2020.

Of course, other climate signals could spike in weeks to come, which would change or amplify the forecast.

We won't know how weak the polar vortex might get and if we'll get a series of atmospheric blocking setups until we get into the heart of winter. Each of these could lead to cooler conditions than currently forecast.

The Weather Company’s primary journalistic mission is to report on breaking weather news, the environment and the importance of science to our lives. This story does not necessarily represent the position of our parent company, IBM.

The Weather Company’s primary journalistic mission is to report on breaking weather news, the environment and the importance of science to our lives. This story does not necessarily represent the position of our parent company, IBM.

No comments:

Post a Comment